Our history

Jump to a decade:

1960s

Inventing an industry

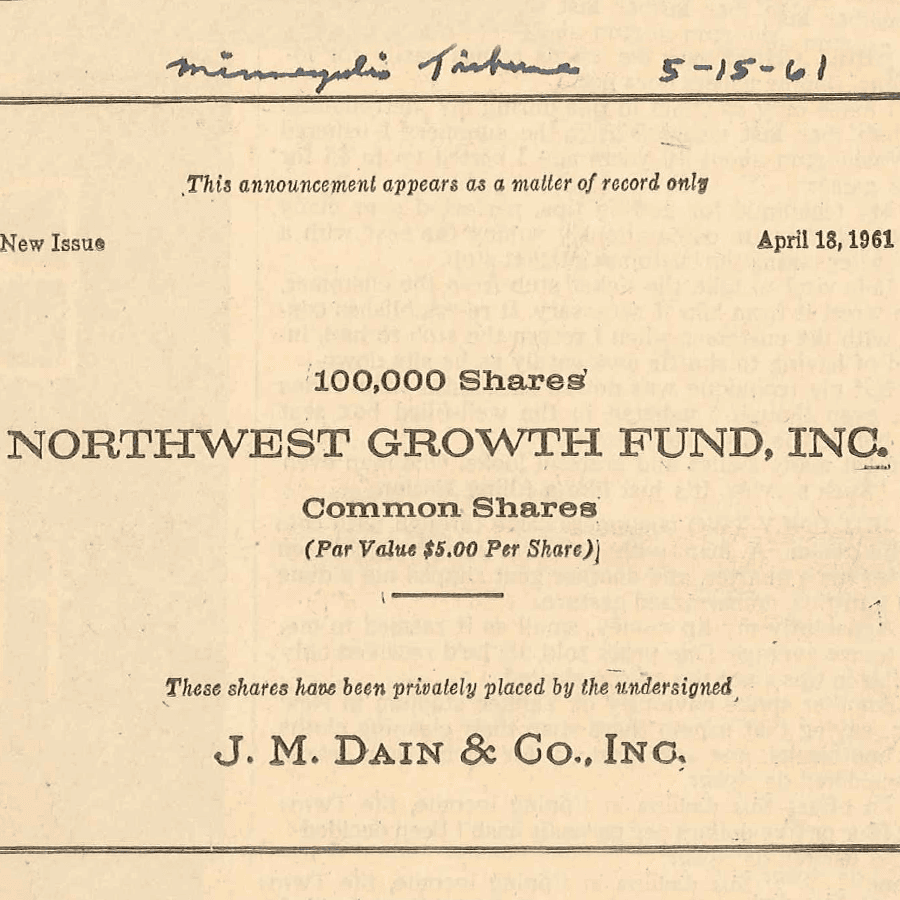

The Small Business Investment Act of 1958 allowed for the establishment of professionally managed investment companies known as SBICs. In 1961, our firm, initially named Northwest Growth Fund (NGF), was founded with a $1.2 million capital raise led by a group of Minneapolis-based business leaders. As one of the first SBIC funds ever raised, we helped launch the small business investing industry.

First Fund

Northwest Growth Fund was launched in 1961 with the intent to form an investment company to support new and developing businesses in Minnesota and across the country.

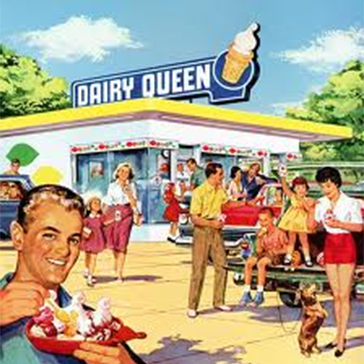

Dairy Queen

We were an early investor in current industry giants such as Dairy Queen.

National Computer Systems

NCS is the creator of the optical test form reader, technology still used today for SAT, ACT, and other standardized tests taken by millions of students.

1970s

Building a National Firm

Our firm made seminal investments in some of Minnesota’s most iconic companies, and our success came during a time of intense growth for SBICs, which many could not sustain. By the end of the decade, we expanded deal-making capacity with key hires, and established a national footprint. By mid-decade, we had invested in more than 50 businesses ranging from apparel and personal products to basic industry, electronics, and industrial and consumer services, illustrating the breadth and depth of our generalist approach to investing.

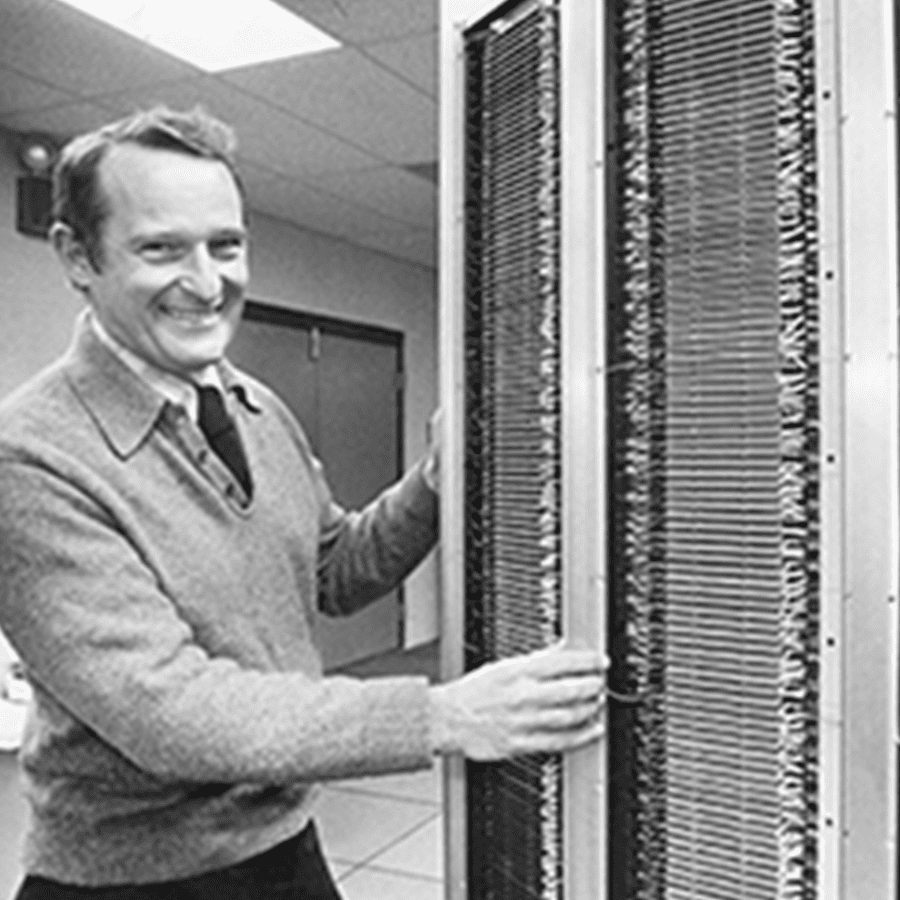

Cray Research

We continued to invest in and help build industry pioneers like Cray Research. Cray grew to become a leader in its industry, building machines that could analyze complex weather patterns and weapons systems for the US Defense Dept and Network Systems, in addition to developing high speed data transmission products that would link powerful mainframe computers and, eventually, the Internet.

Minnetonka Labs

In 1969, we invested in a Minnesota bath and gift company. Minnetonka Labs began as a niche player in the gift soap and novelty toiletries markets. We laid the foundation for the company to enter the mass bar-soap market with pump-dispensed Softsoap liquid soap in 1980.

1980s

Formalization of Early- and Late-Stage Investing Practices

We grew both in concept and geographically, becoming the nation’s third largest SBIC. To fund new investments, we raised Northwest Venture Partners, a $60 million offering. We identified a new asset class called buyouts (“private equity”) and subsequently reorganized under a single umbrella entity focused on both private equity and venture capital. As one of the founding companies of the buyouts business, we launched NEP IV, a $200 million fund, the largest fund ever raised in Minnesota at the time. NEP IV would pave the way for some of the most successful investments at a time when other industry players left the market. We began to operate under the Norwest Equity Partners (NEP) name.

VEE Corp

Founded in 1980, VEE was a trailblazing family entertainment company that produced Sesame Street Live, a touring stage show based on the TV series. We helped them get their show on the road, which is still touring today!

Stearns Manufacturing

We helped a Minnesota company grow to achieve virtual ownership of the designed personal flotation device market.

Norwesco

Norwesco has been North America’s leading manufacturer of proprietary, rotationally molded polyethylene tanks for agricultural, water, closed-top industrial and below ground septic and cistern applications. During our investment partnership with management, Norwesco improved its market dominance and leading market share position and continued to realize numerous growth initiatives including multiple add-on acquisitions.

1990s

Separation of Equity and Venture Business

Our firm moved onto the national stage as private equity business in the U.S. surged, and went on to raise $300 million for NEP V. When the market began to identify venture capital and private equity as two separate industries, our venture business migrated to Silicon Valley to be closer to the technology market while our private equity business remained in the Midwest to focus exclusively on buyouts. We launched NEP VI in 1997 with $250 million and, just two years later, raised NEP VII with $800 million.

Select Comfort

Now known as Sleep Number, Select Comfort was founded in 1987 as a groundbreaker in the new category of adjustable air-supported sleep systems. We invested in the company in 1995 to help drive its next chapter of growth.

Lifetime Fitness

This partnership launched our active lifestyle investing platform. Together, we developed a new national standard of health clubs, built a world-class management team, expanded the company’s service offering, refined its site selection model, and transformed Lifetime into a national brand.

Pelican Products

We partnered with Pelican management to develop and grow the company’s international business, launch significant product development, expand into attractive new end markets, and broaden the company’s diverse customer base and global distribution.

2000s

Foundational Shift to Modern NEP, Mezz Business Launches

Regulatory changes enabled us to have more flexibility invest in larger deals with a broader investment strategy mandate. This included growing and building an operating resource group* to help support and drive portfolio operational excellence and growth needs. We introduced Norwest Mezzanine Partners (NMP) in 2000 with $250 million, providing new avenues of growth and flexibility, and responding to the need for ready access to financing as integral to help portfolio companies complete acquisitions to finance. In 2004, we launched NEP VIII with $800 million with an additional $400 million for NMP II. Four years later, we raised our largest fund to date, NEP IX, with $1.2 billion while NMP raised $750 million for NMP III.

Becker Underwood

We saw more potential in this global leader in seed enhancements and biological products that improve crop sustainability and enhance yields for growers around the world. Over the course of our investment, Becker Underwood completed eight strategic add-on acquisitions.

Shock Doctor

Known as a leader in mouthguard technology and considered a major innovator in sports protection around the globe, we worked together with management to create and acquire new product lines that helped expand the company's leading position in its category.

Imperial Supplies

Founded in 1958, Imperial Supplies is a national distributor of quality maintenance products. Through innovative IT, Imperial offers customers highly efficient ways to order and monitor purchases, as well as lower their costs.

Warn Industries

With customers in more than 65 countries on six continents, Warn is one of the world’s most recognized brands in vehicle performance enhancing equipment.

CVI Laser

We helped CVI Melles Griot build and establish a strong management team, leverage its brand heritage in optical components, and aggressively expand its product offerings to transition into a diversified photonics supplier. During our investment, CVI established manufacturing operations in eight countries on three continents, increased shareholder value through new product and market development, and added four acquisitions, operating initiatives, and a growth strategy focused on technology-driven capabilities.

Paladin

Paladin Brands is an independent maker of high-quality construction equipment attachments such as augers, backhoes, trenchers, excavator buckets and mobile shears. During our investment with Paladin, the company completed seven acquisitions in 16 months while also growing organically.

Jacobson

We partnered with national 3PL leader Jacobson to develop and execute four add-on acquisitions that helped broaden its customer base, geographic footprint, and product offering.

2010s

Building the Firm for the Future

We celebrated a milestone 50th anniversary, a rare occasion in our industry. Together with NMP, we raised our largest pools of capital to date, NEP X with $1.6 billion and NMP IV with $1.2 billion. New, larger fund sizes helped shift our investing strategy as we focused on becoming more control investors and partnering with first-time sellers. We employed significant capital and resources to augment our investing and operational needs for continued growth including increasing headcount, innovating technology, and strategic expansion initiatives.

Gopher Resource

Founded in 1946, Gopher Resource is an innovative lead processor that recycles lead-acid batteries and other lead-bearing materials, with a majority of the refined lead used in automotive and industrial batteries. Additionally, the company recycles more than 19 million pounds of polypropylene annually from battery casings through its subsidiary, Resource Plastics.

Actagro

We grew global plant nutrient technology leader, Actagro, creator of environmentally sustainable soil and plant technology solutions that help growers achieve higher crop yields.

Momentum

One of the nation’s leaders in the textile design industry, Momentum creates and supplies a variety of sustainable textiles for the commercial interiors industry. We supported an exceptional management team and culture and focused on innovation, strategic planning, and operational excellence to drive strong growth during our ownership.

Minnesota Rubber & Plastics

MR&P is a contract manufacturer of customized, mission critical rubber and thermoplastic components and assemblies. Over the duration of our six-year investment period, we worked closely with the MR&P leadership team to significantly impact the performance of the company and enter new markets.

Wahoo

Wahoo is a highly innovative fitness technology company serving cyclists, triathletes and other endurance athletes. Their portfolio of differentiated products created an attractive base business with capabilities to continue innovating and further establishing itself as the premier smart training company. We provided growth capital to accelerate product ecosystem development and scale the the organization.

2020s

Expanding Our Capabilities

Starting a new decade with unprecedented global dynamics shed light on the importance of relationships and resiliency, as well as flexibility. A new wave of investor and operations leaders joined the firm to help usher NEP into its 60th year of business while NMP celebrated its 20th. We opened a second office location in Southeast Florida to help broaden our reach to a robust market for growing and profitable companies. We also moved our MN team to a new office in the Minneapolis. One of the most important milestones of this decade was organizing NEP and NMP under one independent entity as a registered investment advisor with the SEC, Norwest Capital, a true testament to the firm’s future growth ambitions. We continue to strengthen our firm’s support of our communities, investing resources and ourselves, and supporting our companies and employees as they make a difference in the communities where we live and work.

Thibaut

As the nation’s oldest wallpaper company established in 1886, Thibaut is a designer and provider of a variety of wallcoverings, fabrics, tapes/trim, and woven upholstery fabrics. Our team has partnered with Thibaut to position the company for continued growth.

Coretelligent

A recent addition to our business services portfolio, Coretelligent is a provider of comprehensive managed IT, cybersecurity, and cloud services. We are working with the executive team to realize the strategic vision and roadmap, including adding two successful acquisitions within the first year of investment.

recteq

recteq fits our consumer products’ focus seamlessly. recteq is a multi-faceted designer, marketer, and direct seller of technology-driven premium pellet grills, accessories, and other outdoor products. We are excited for the opportunity to work together with the recteq team to take the company to the next level.